Corporate America’s Banner Year: Please Understand That They Hate You

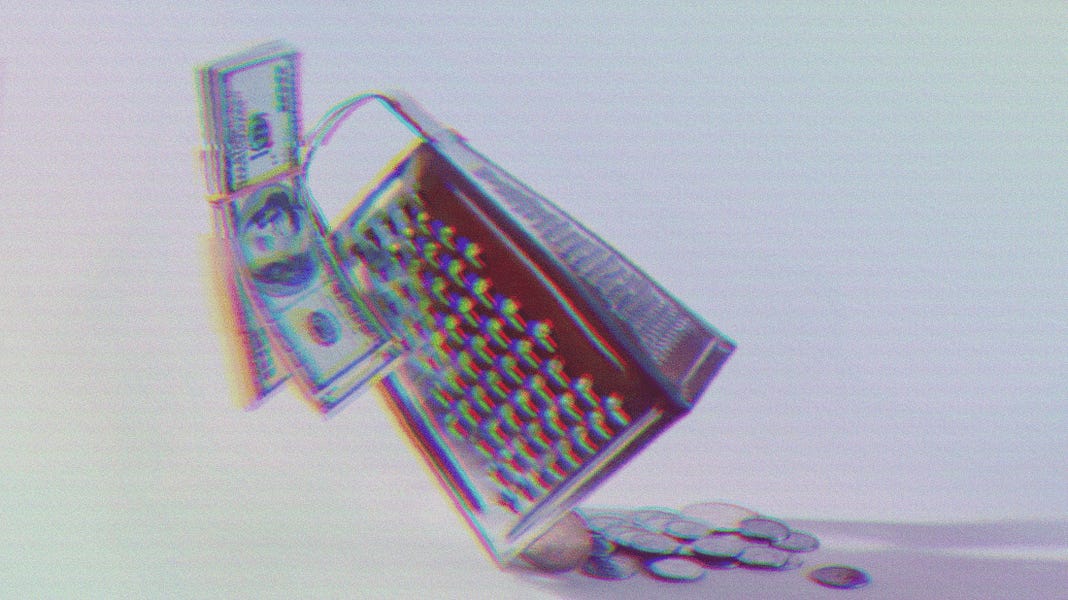

Image Description: Cash being grated, with coins coming out of the grater, inflation concept.

Image Description: Cash being grated, with coins coming out of the grater, inflation concept.

The biggest and most misunderstood story of the hour is inflation. The reporting on it is so fucked that it’s preventing me from moving on to our other tasks at hand. But it’s super important that we get this right because we’re in one of those periods where sentiment changes quickly based on a certain set of assumptions, and these sentiments lead to bad policy decisions for the sake of political expediency.

In the episode, we played a few recent news clips to demonstrate the intensity of the coverage, but also how flawed the analyses are. Here’s a transcript of the craziest one (notated by yours truly) that we pulled from MSNBC, lest this turn into a conservative bashing zone. Everyone is getting this shit wrong. See for yourself:

“The problem that we have here is that there’s a series of events that have led to higher prices. When people call in sick because of having the virus, it reduces the supply of goods to the economy. (Prices are higher because people took sick days?) We have a problem with wages going up. (Sure, this year. But nominal share of wage growth for workers still hasn’t recovered from the Great Recession you fucking, fuckstick fascist.) We have a problem with commodities, our ports and supplies are backed up, and I just don’t see any relief from that anytime soon. (Yeah, for big shit, but most of the consumer items that matter in our daily lives haven’t experienced supply chain disruption.) Even when it comes to gas prices, sometimes they spike, and they start to come down as you have an increase in production. We don’t hear OPEC increasing production very much, so I’m afraid this number is bad and could get worse before it gets better towards the end of the year. (OPEC nations have literally increased production every single month for the past 18 months. Every. Single. Fucking. Month.)”

The episode features additional clips from Mad Money’s Jim Cramer, CNBC and ABC to illustrate how pervasive these insane narratives are and how no corporate media host has the background or intellect to question these kinds of statements. I deliberately selected a few recent clips from non-conservative outlets.

Because the only real frame of reference for inflation we have in this country, within a memorable time frame for citizens and policymakers, is the 1970s. It remains one of the most fascinating periods. And also the most misunderstood. The reason I’m digging back into this discussion today is because inflation is the most pressing economic issue of the day, and we’re getting the discussion very, very wrong. Before we unf*ck things a bit, I want you to hold onto a concept at the beginning that we’ll return to at the end. We’re going to go through a bunch of financial blahbiddyblooh today, but I want you to remember these numbers specifically.

Let’s do really simple math

The Institute on Taxation and Economic Policy estimated the average American household received $3,400 in stimulus in 2021. And as ABC has stated, it’s estimated that inflation cost the average household an additional $275 per month. That works out to $3,300 a year.

Numbers have a tendency to make the mind go numb, so just hold onto these.

The first clip transcribed above is filled with red herrings, but circulated with such certainty that it can make you feel a bit crazy. I mean, blaming 7.5% inflation on people calling in sick and OPEC releasing too much supply? If you’re not versed in economics, these are the kind of pronouncements that gain an air of legitimacy and become baked into the narrative.

And, ABC casually says that goods purchased by the average American consumer, from cereal to coffee, are more expensive, without delving into the reasons behind it. The underlying assumption that most people then make is that government policies have something to do with it.

But our villain here isn’t the government, and that’s why we need to return to this issue and make sense of it. I want to go through the '70s in a bit because it shows you just how long the post traumatic effects of high inflation can last.

I cracked open an old macroeconomics textbook from college to level set on a key outcome of inflation. Here goes.

“During inflation, money loses its value. Thus the losers are those whose income or receipts are stable in money terms. These include:

People who are working for a wage or salary that is fixed in dollar terms.

Any business that has undertaken to deliver goods or services in the future at fixed prices.

Retirees who receive pensions fixed in dollar terms.

Those who have bought bonds or have loaned money in other ways. They are eventually paid back in dollars that are worth less.

There you go. So I want to be very clear in saying that inflation is a problem, and at no point will I make light of this phenomenon as it relates to working people, businesses, and certainly retirees. In fact, the point is to illustrate something else my textbook says:

“Businesses that employ workers at stable wages will win if the prices of what they sell rise more rapidly than their costs.”

As we often cover in our economic heavy episodes, matters of money are never one sided. There are always winners and losers. It just invariably seems like those two camps are always the same. In terms of the arguments behind the causes of inflation, we need to dispense with the biggest argument we hear, and that’s the one about government spending.

Chapter One

Ricardian Equivalence

The concept known as Modern Monetary Theory has deep roots. Obviously, we covered it in our MMT specific episode, but we did it in a modern framework, primarily to demonstrate that government spending that doesn’t directly impact the consumer, has almost no effect on inflation. Our purpose there was to defend the stimulus and infrastructure bills that went to shore up things like bridges, tunnels, roads, as well as unemployment insurance, etc.

I’m going to carve out direct payments and return to them in a bit, but the real point behind our MMT work thus far was to dispel the deficit myth, the title of Stephanie Kelton’s MMT book, particularly as it relates to defense spending. Essentially, if going into deeper national debt and expanding money supply creates inflation as a rule, then our reckless military spending would have done exactly that 10 times over. But it doesn’t. The deep roots I’m talking about go as far back as David Ricardo, one of the most influential economists and social theorists in history.

Here’s a passage from Thomas Piketty’s seminal work, Capital:

“When David Ricardo formulated in 1817 the hypothesis known today as the Ricardian equivalence, according to which, under certain conditions, public debt has no effect on the accumulation of national capital, he was obviously strongly influenced by what he witnessed around him. At the moment he wrote, British public debt was close to 200 percent of GDP, yet it seemed not to have dried up the flow of private investment or the accumulation of capital.”

Piketty acknowledges this is not a universal law, but the idea is important to us, as it returns over and over again over time.

Ricardo’s Equivalence has come to explain the disconnect between the real economy of the people and the economic behavior of nations. It can also explain a bit about how the markets work, because it essentially demonstrates that people act rationally based upon expectations and bake in certain assumptions about their pocketbook. For example, if the government gives individuals a tax cut, people don’t necessarily go out and spend a whole bunch of extra money. They simply assume that the government giveth and taketh away and that this will be a temporary condition. At some point, the government is going to come calling and take it back.

To wit, when the most impoverished Americans received direct payments last year, the research shows that nearly all of the money went to pay for food, rent and debt. There wasn’t a run on luxury goods all of a sudden. That’s not how normal people behave. People predominantly act in accordance with their basic needs first. It’s only when wealth accumulation is sustained, such as we’ve seen among the top 1%, that people will begin to spend on non-necessities.

It’s why Americans didn’t suddenly pull back on their own personal spending or panic when the government went wildly into debt over protracted wars in the Middle East. Ricardo’s theory holds in modern terms if we take Japan, for example. We’ll use them to illustrate two points.

The Japanese economy just recorded a second straight month of inflation growth, with core consumer prices rising .5%. But that was less than the target, and the majority was due to a 22% increase in fuel prices, driven by commodity speculation in the global markets. Japan, like many other energy dependent countries, will feel the effects of this directly and dramatically. But the central bank in Japan doesn’t foresee a change to monetary policy, as they don’t expect price increases in consumer goods like we will in the United States. Why? Because their corporations didn’t increase prices.

And, again, as far as the government spending and debt to GDP are concerned, recall our other lesson from Japan in the MMT episode. If government spending was the cause of inflation, Japan would be out of control, as their debt to GDP ratio is 250% to our 127%. So the government spending argument goes out the window, and Ricardo’s theory is upheld.

Nevertheless, the pundit class still maintains that the government is putting too much money into your hands, and you’re to blame for causing inflation. But nearly every other industrialized nation followed suit with direct payments, and far more robust than we did, in many cases; but inflation didn’t immediately materialize when Trump did it. And the last major direct increase in government spending, money that actually impacted Americans in the form of a stimulus, was already a year ago—and that money is gone baby gone. Remember that the itsfuckedforsure money has yet to be spent, and we won’t see the impact of it for several years to come.

The government spending issue simply doesn’t hold water. It’s not the cause of our particular brand of inflation. And that brings up another key difference in theories, mostly between the Keynesian and Friedman camps. One of the most important selling points of the Friedman camp was simplicity. Uncle Dicknoggin (Friedman) spoke about inflation in absolute terms. Terms that politicians and people could understand. If you print too much money, it will cause inflation, and inflation is the worst thing that can happen. Period.

It’s one of the reasons that Friedman acolytes believe that some unemployment is absolutely necessary to contain inflation. There are a couple of names for this general theory, one is wage price spiral. The more employment there is, the more control employees have over wage pressure.

There is some truth to this, so I don’t want to discount it entirely. This is a backbone assumption of all economic theory, but one that the Friedman camp places far too much value on because, again, people are rational. The number of available jobs, alignment of expertise and fundamentals of what the market will bear all impact wages. But in Friedman’s world, some people need to be without in order for corporations to be with.

The acceptance of this narrative turned American economics, and subsequently, most western nations, into a very black and white issue. It was already prevailing wisdom by the time of Nixon, as Binyamin Appelbaum writes in The Economist’s Hour, saying:

“He (Nixon) believed the government faced a choice between inflation and unemployment, and he knew what he wanted to order from that menu. He explained to aides that nobody lost elections because of inflation, telling them, ‘Unemployment is always a bigger issue.’ It was this mentality and the simplicity of thought that led the Nixon team to do many of the things that would ultimately set up the late '70s and '80s for an implosion and create the circumstances for stagflation.”

We’re going to hang a bit in the '70s now, as promised, because it set the stage for more than stagflation. So let’s look at Nixon’s response to a slowing economy that had enjoyed two decades of unparalleled growth in the post war boom. One lever they pulled was price controls. I bring it up because, at some point today, this might feel like an obvious solution for what ails us today. Just force corporations to limit price increases. But as Appelbaum writes:

“The price controls were popular and briefly effective, but distortions soon burst into view. In June 1973, the evening news showed footage of workers at an east Texas chicken farm drowning forty-three thousand chicks by dumping them into oil drums because the price of feeding chickens had climbed above the price of chicken. ‘It’s cheaper to drown ‘em,’ the owner explained.”

Bottom line. Quick fixes are rarely the answer, and artificially manipulating a market economy can have dramatic consequences. Keynesian economists view the world in far more complex terms and believe every era, every circumstance is different, and there are multiple levers to pull depending upon certain inputs. With that in mind, let’s look more closely at what’s happening at this moment. We’re looking specifically at three major inputs of inflation. Housing, crude oil and consumer goods.

Chapter Two

Housing

Housing is the smallest segment of our episode today, but that’s not meant to imply that it’s a small issue. But housing is multifaceted, and trends take a while to develop in this market, so it’s less a part of the immediate narrative. Having said that, it’s part of a much larger story that deserves its own unf*cking in due course.

But for our purposes today, there are some troubling developments that are creating inflationary pressures on home buyers and renters. And these pressures are preventing some from achieving the “American dream.”

Ah, yes. The real American dream. Home ownership. Recall the days of yesteryear when returning GIs were given an opportunity to own a home of their own.

MANNY: If they were white.

If they were white. Right, correct you are. As I was saying, the days of yesteryear when a white returning GI was given a chance at home ownership through government programs that…

99: And only men, mind you. Credit wasn’t extended to women for another 20 years.

Again, correct you are. Ah home ownership, the…oh, fuck it.

You know housing policy has been discriminatory since forever in America. That’s why 36% of the 122 million households in the United States are still headed by renters, and the numbers are drastically skewed against ethnic minorities for the structural issues we covered in our economics of racism episode, and young people who don’t earn enough to afford housing in today’s market.

Here’s where we need to give room to the supply chain argument, at least in terms of new housing and construction. Part of the issue today is that big ticket items like raw materials are still expensive, and inventory through international trade routes has yet to sort itself out. In terms of the rental market, renters found relief from evictions during the pandemic, but as those programs come to an end, landlords are moving to get back lost revenues in what could become the next great housing crisis. There is a ton of demand and too little supply.

But in terms of the pure rental market, there’s another fucked up development that is finally getting some attention. According to a ProPublica special report, they discovered:

“Large private equity firms accounted for 85% of Freddie Mac’s 20 biggest deals financing apartment complex purchases by a single borrower… All but one of those deals occurred in 2015 or later, as low interest rates propelled private equity firms to seek billions in Freddie-backed loans for mass apartment purchases.”

Today, private equity firms own and control more than a million rental units, and the number is growing rapidly each year. Might not sound like a lot, but as you might imagine, they’re buying properties in cities and other densely populated areas, cutting expenses and jacking rents. So the impact they’re having on urban areas is outsized and extremely dangerous for low wage workers who are increasingly being pushed out by corporate gentrification.

Across the board, the numbers are pretty bleak. Demand is so high that, according to rent.com, the median rent in 2018 was $1,027. In 2020, it was $1,104. Rents are projected to increase in 2022 over last year by 21%. Why? Because they can. There’s nothing else at work here, and this is just one of those areas where taken in isolation seems problematic, sure. But in conjunction with the rest of the fuckery we’re about to go through, it has all the hallmarks of a crisis.

Chapter Three

Crude Oil

Yeah, crude oil. I know you’re probably all like, “Max, the horse is dead. Stop beating it.” But I can’t because, wouldn’t you know it, these fuckers are back at it again. In fact, it will make more sense than ever because we literally just went through it in a recent episode.

So start with the Japan example from before. The reason they’re experiencing marginal inflation right now is predominantly due to the 22% increase in fuel oil. If you have a wallet and car, I certainly don’t need to tell you about prices at the pump. These are always lagging, by the way, so even more pain is to come because crude prices are spiking right now.

The networks are running hog wild with the Ukraine narrative, but this fairly recent development doesn’t explain the trendline over the last year when prices have been hitting some remarkable highs. The two main economic factors behind oil prices are supply and demand, or dollar strength and weakness. The primary political factor behind oil prices is typically sanctions or upheaval that leads to supply disruption. So, different, but related.

But the real driver, ever since Leo Melamed decided to turn everything in the world into a gambling chit, is the commodity trader. We unpacked this deliciously evil scenario in our peak oil show, so you know how much these fuckers can move a market simply by forecasting high prices.

To dispense with the supply and demand notion, allow me to illustrate how supply and demand—because we have so many sources for crude—always move together. And it’s been that way for literally 50 years since the big oil shock of the '70s. Essentially, there’s always enough supply to meet demand.

Essentially, even if demand suddenly skyrockets, as it did post COVID, not only do we pump enough out of the ground to meet demand, we have enough in reserves around the world to fill the gaps in production while they ramp up. When you hear about “strategic reserves,” that’s what they’re talking about, and we’re not the only ones who have them.

In terms of pricing, dig this. Demand for crude oil in 2018 was 99 million barrels a day. In 2019, it was 99.7. Pricing was $75 and $65, respectively, and had more to do with fluctuations in the dollar. But that’s about the new normal for the settled price of crude when demand is around 99 million barrels.

At the height of the pandemic, demand dropped to 91 million barrels and, because it was so sudden and we had such robust reserves, price cratered along with demand. In 2021, demand built back to 96 million barrels, and it’s projected to hit 99 again in 2022 and 101 in 2023. So, we’re essentially back in business to where we were at 2018 and 2019 levels.

And yet, these fucktits on Wall Street keep signaling higher and higher prices.

Now, see if you can spot the difference in the narratives I’m about to give you.

Let’s start with the true story first from the Energy Information Administration (EIA), the agency we covered in our Peak Oil episode. I’m quoting from their most recent projection:

“In our January 2022 Short-Term Energy Outlook (STEO), we forecast that crude oil prices will fall from 2021 levels. In the fourth quarter of 2021, the price of Brent crude oil, the international pricing benchmark, averaged $79 per barrel (b). We forecast that the price of Brent will average $75/b in 2022 and $68/b in 2023. The declining prices are driven by a shift from global petroleum inventory declines during 2021 to inventory increases in 2022 and 2023.”

So these are the absolute price projections that the leading energy agency on the planet foresees over the next two years. A high of $79 and dropping. Remember, that’s not to suggest a long-term decline in consumption, as we discussed. The all-things-being-equal scenario is that production and demand will level off over the next few years, then increase in the out years to 2050 if we don’t do something to mitigate the growth of fossil fuel usage in developing countries and throughout Asia. Different story. To that end, here’s the endcap of the forecast:

“We forecast that global petroleum consumption will increase by 3.6 million b/d in 2022, driven by more consumption in the United States and China, which together account for 39% of the consumption growth. We forecast that global petroleum inventories will increase by 0.5 million b/d in 2022, which will put downward pressure on crude oil prices. We forecast that the price of Brent crude oil in 2022 will fall from $79/b in the first quarter to $71/b in the fourth quarter.”

I’m including this to demonstrate that these aren’t pie in the sky figures. These are hard and fast economic models that are nearly always spot on, barring unforeseen events like an embargo.

Now, let’s check in with Wall Street and see if you can spot the difference because, as of this recording, Brent and West Texas Intermediary, the two most important benchmarks, are both trading in the mid $90 range. Here are a few excerpts from a Barron’s article this month:

“RBC Capital Markets explained one scenario where oil prices could jump to record levels. It has more to do with demand than supply. For now, analyst Michael Tran sees very little pressure on the supply side to restrain prices. Oil supplies are growing at a relatively slow rate, in part because OPEC has been unwilling—and potentially unable—to boost production.”

The report goes on to quote Tran and other analysts saying:

“To be sure, RBC isn’t projecting $150 oil or even trying to accurately predict the moment oil peaks. If current trends hold, Tran thinks oil can ‘touch or flirt with $115 per barrel or higher’ this summer. Truist analyst Neal Dingmann is also predicting higher oil prices, writing on Monday that prices above $125 are possible ‘soon’ as geopolitical tensions continue to escalate.

Credit Suisse’s Manav Gupta thinks that even if the standoff in Europe cools off, prices might still rise more.”

There are media segments and articles all over the place talking about how prices could exceed $150 a barrel and possibly hit $200, all taken from the fervor created among these analysts who are spiking the fucking punch bowl, just like they did in the example we gave when Morgan and Goldman were in a race to push prices to $150 a few years ago. And what happened? They did it. And why did they do it? Because the banks needed liquidity and held enormous leveraged positions in the commodities markets. High prices are great for three camps. Oligarchs, oil companies and Wall Street.

There is simply no economic rationale for oil prices to continue surging to preposterous levels like the ones touted by these analysts. We fell for that once already. As George W. Bush said, fool me once, shame on. You fool again, the second time, you’re not gonna. Fool me twice and it’s a shame.

Chapter Four

Corporate Greed

And that, my dear Unf*ckers, brings us to the third leg of the asshole stool, and that’s corporate greed. We’re going back to our Kellogg’s “taking price” example now and broadening it a bit to prove our thesis about current inflation.

I’ve selected ten of the largest consumer good manufacturing companies in the world to highlight.

The companies I examined are: Tyson Foods, Nestlé, Procter & Gamble, PepsiCo, JBS, Unilever, 3M, L’Oréal, LVMH and AB InBev. My goal was to examine a huge swath of companies that have products on your shelves, from food and beverage to health care and personal care products. It’s a basket of consumer goods that are, for better or worse, representative of the core basis for inflationary trends in practical terms for the consumer.

These ten companies have a combined revenue of a half a trillion dollars. These are the market makers and market movers. Each is multinational, so they’re not pulling all of their revenue from the United States, but that’s an important part of the story. More on that later.

For expediency, we’re going to comb through the annual reports and investor relations decks of three, specifically. While we’re not going to drill into the other seven on the list, the lesson here is that what we discuss holds true for each of them. And while this is only a partial list—seriously a very small cross section of the brands these other seven companies control—it will give you an idea of how ingrained they are in our daily lives. Here’s a snapshot of the brands they control:

-

Pepsi, Tropicana, Lay’s, Doritos, Gatorade, Starbucks Bottled Coffee Drinks

-

Moy Park, Primo, Certified Angus Beef, Ozo, Pilgrim’s

-

Hellmans’, Dove, Ben & Jerry’s, Vaseline, Lipton

-

Post-It, Scotch, Command, Scotch-Brite, Scotchguard

-

Maybelline, Garnier, Yves Saint Laurent Beauty Products, Prada Fragrances, Giorgio Armani Beauty

-

Louis Vuitton, Christian Dior Couture, Fendi, Tiffany & Co., Bulgari

-

Budweiser, Corona, Becks, Modelo, Stella Artois, Gose Island

Impressive, no? Let me state up front that these companies aren’t all bad. They all employ a shit ton of people. Some have very impressive wages and benefits. And while none of them, in my humble opinion, pay enough in corporate taxes, they are by no means tax evaders the likes of some of the big tech companies, investment banks or fossil fuel companies. On the flip side, most of their products are absolute shit that either harm us personally or harm the environment.

And no matter how much lip service they pay to sustainability and other ESG measures, it’s fucking bullshit. They make some fine products, are really good at marketing, employ a bunch of people, yada yada, but in terms of social and environmental impact, they’re all terrible. But we need to acknowledge that they make the world go around the consumer economy hum.

Behind all of these shitty products, there are manufacturing, distribution, marketing and retail channels, all supported by these companies and thousands of others just like them. So there’s a multiplier effect to their largesse that shows up in other parts of the global economy and puts food on people’s tables. That’s not our story today, however.

Our story today is to show how they deliberately targeted the American people in their pursuit of profit. Motivated purely by greed and secure in the fact that, not only will we not really notice how they’re fucking us, they’re actively engaged in shifting the blame.

The three we’re going to slice and dice are Tyson, Nestlé and Procter & Gamble because they’re the most representative of everyday consumer products you might find in your home. These three companies alone have revenue of more than $200 billion annually and are considered the stable stalwarts of big business in consumer products. Without further ado, let’s tackle the biggest asshole first.

Tyson Foods

Open your cupboard and fridge and holler when I call out a product you have in your home. If you’re a vegan like 99, you can pass on this. But for most Americans, it’s pretty amazing.

Tyson, Jimmy Dean, Hillshire Farm, BallPark, Raised and Rooted, Aidells sausage, State Fair, Nature Raised Farms, Sara Lee, Wright Brand, Bosco’s, Gallo Salame, Bonici, The Bruss Company, Chairman’s Reserve, IBP, Lady Aster, Mexican Original, Open Prairie, Star Ranch Angus, Wunderbar, AdvancePierre Foods, Barber Foods, BigAZ, Fast Fixin’, Like Mom’s Landshire, Russer, Steak EZE, OriginalPhilly, Bryan and Reuben.

I’m going directly to their annual report for financial highlights and commentary that they are required to release to the public. At a certain point in this and our two other examples, I’ll make sure to call out the ickiest part, so you don’t miss it.

Here’s 2021 vs. 2020 sales only:

“Sales were negatively impacted by a decrease in sales volume across each of our segments, which accounted for a decrease of $1,190 million, due in part to the impacts of a challenging labor environment, as well as the impact of an additional week in fiscal 2020.”

Hmm. Sales were down? Wow. How ever did they survive? Let’s read on.

“Sales were positively impacted by higher average sales prices, which accounted for an increase of $5,599 million. The increase in average sales price was primarily attributable to favorable product mix and the pass through of increased raw material costs.”

The upshot of this price manipulation was an increase in net income from $3 billion in 2020 to $4.4 billion in 2021 on sales of $47 billion. Pulling these figures together is a monumental task, by the way, because they have a few subsidiaries across the world. About 175 actually, including the United States, Australia, Philippines, Turkey, Columbia, Netherlands, U.K. Peru, Brazil, New Zealand, Cayman Islands, China, Luxembourg, Malawi, Spain, Italy, Korea, Canada, Singapore, Bermuda, Uruguay and Portugal.

Ah, yes. Luxembourg and the Caymans. Manufacturing hubs of the world.

Now, in fairness, they paid an effective tax rate of 24.3% for fiscal year 2021, which is more than I can say for the tech giants and big banks, so there’s that. All told, it’s a lot to manage, which is why their top five executives “only” brought in $47 million in compensation last year.

So here’s the most important line: “Average sales price increased due to favorable sales mix and inflationary market conditions.”

Same story as before. They saw an opportunity to increase prices beyond what would have compensated for any increases in expenses, and exacted a toll on the American consumer by pushing their increased profits through to us by raising prices.

Nestlé

Heading over to the real giant in the world now, Nestlé. One of the shittiest companies on God’s green earth and manufacturers of Alpo, Purina, Boost, Carnation, Cheerios, Coffee-Mate, DiGiorno, Dreyer’s Ice Cream, Fancy Feast, Friskies, Gerber, Häagen-Dazs, Hot Pockets, Kit Kat, Lean Cuisine, Nescafé, Nespresso, Nestea, Purina, Perrier, Starbucks Coffee at Home, Stouffer’s, Toll House and Tombstone Pizza.

Don’t buy any of these name brand items? That’s okay. They have more than 2,000, so I’m sure there’s something Nestlé on your shelves.

Let’s take a look at their third quarter earnings (their annual report drops after this writing) and their forward guidance for what 2021 should look like:

“Organic growth reached 7.6%, with real internal growth (RIG) of 6.0% and pricing of 1.6%. Growth was supported by continued momentum in retail sales, steady recovery of out-of-home channels, increased pricing and market share gains.

“Total reported sales increased by 2.2% to CHF 63.3 billion (9M-2020: CHF 61.9 billion).

“Full-year guidance for 2021 updated: we expect full-year organic sales growth between 6% and 7%. The underlying trading operating profit margin is expected around 17.5%, reflecting initial time delays between input cost inflation and pricing, as well as the one-off integration costs related to the acquisition of The Bountiful Company's core brands. Beyond 2021, our mid-term outlook for continued moderate margin improvement remains unchanged. Underlying earnings per share in constant currency and capital efficiency are expected to increase this year.”

So they’re growing organically everywhere and increasing prices, as well all leading to top line revenue growth and a 17.5% profit margin. I just want to check something. Presumabl,y the inflation inputs they talked about are global, so I’m sure prices went up everywhere, right?

Zone Asia, Oceania and sub-Saharan Africa (AOA)

4.1% organic growth: 3.9% RIG; 0.2% pricing.

Zone Europe, Middle-East and North Africa (EMENA)

7.2% organic growth: 6.4% RIG; 0.8% pricing.

Zone Americas (AMS)

8.4% organic growth: 5.2% RIG; 3.2% pricing.

Wait a minute. So they increase pricing .2% in Asia, Oceania and sub-Saharan Africa, .8% in Europe the Middle East and North Africa and 3.2% in the Americas? Yup. The only sucker that wound up paying more for their shitty products was us.

Procter and Gamble

To round things out, let’s take a look at one of the most lauded and stable American companies that ever existed. Good old P&G, Procter and Gamble. You might know them better by their brands:

Pampers, Bounce, Downy, Dreft, Tide, Bounty, Charmin, Always, Tampax, Braun, Gillette, Head & Shoulders, Old Spice, Herbal Essences, Pantene, My Black is Beautiful, Cascade, Febreze, Dawn, Swiffer, Mr. Clean, Crest, Scope, Metamucil, Vicks, Pepto-Bismol and Secret.

Yet again, a banner fucking year for corporate America baby. Quoting again from their 10-K, which is what the SEC annual report filing is called:

“The primary factors driving year-over-year changes in net sales include overall market growth in the categories in which we compete, product initiatives, competitive activities (the level of initiatives, pricing and other activities by competitors), marketing spending, retail executions (both in-store and online), and acquisition and divestiture activity, all of which drive changes in our underlying unit volume, as well as our pricing actions (which can also impact volume), changes in product and geographic mix and foreign currency impacts on sales outside the U.S.”

And what were those results? A 7% increase in sales from $70 billion to $76 billion and a 15% increase in profits from $15.7 billion to $17.9 billion! Well done, P&G. How did you pull off double the profit margin growth over revenue growth?

“The primary drivers of changes in gross margin are input costs (energy and other commodities), pricing impacts, geographic mix (for example, gross margins in North America are generally higher than the Company average for similar products).”

Oooohhhh. You “took price,” but mostly from Americans! I get it. Not only that, but P&G is sitting on an eye-popping $10 billion in cash and were able to pay less than their counterparts with an effective tax rate of only 18.2% in the United States.

It’s always the same old fucking story

No need to belabor the point I guess. But I do want to revisit the numbers from the beginning of the show to drive this home.

“The Institute on Taxation and Economic Policy estimated the average American household received $3,400 in stimulus in 2021. And as ABC has stated, it’s estimated that inflation cost the average household an additional $275 per month. That works out to $3,300 a year.”

Prices increased on consumer goods.

But only in America.

Why?

Because you had the money.

They saw that you had an additional $3,400 in your pocket, so they all put their grubby hands in your pocket and picked it. They took $3,300 of it back. Between these assholes and the speculative fuckheads on Wall Street who are unnaturally driving up oil prices beyond what is reasonable by any economic models or standards, they fleeced us all. That extra $100? They’ll be back for it. I promise you.

And the housing crisis has yet to explode, but when private equity gets into the game, I can promise you this. The only fucking winners are the private equity firms. It’s a zero sum game for them all the time, never not.

When we explored the inflation question as it related to GDP in the Quickie, it was still big picture and very theoretical. But when you put it in real dollars and cents terms and expose the lies behind the narrative, there’s no escaping the reality that corporate America’s banner year was at your expense.

Numbers don’t lie. But corporations do. All. The. Time.

Here endeth the lesson.

Max is a political commentator and essayist who focuses on the intersection of American socioeconomic theory and politics in the modern era. He is the publisher of UNFTR Media and host of the popular Unf*cking the Republic® podcast and YouTube channel. Prior to founding UNFTR, Max spent fifteen years as a publisher and columnist in the alternative newsweekly industry and a decade in terrestrial radio. Max is also a regular contributor to the MeidasTouch Network where he covers the U.S. economy.