Why Trickle-Down Economics Was Always a Scam.

The Great Wealth Transfer.

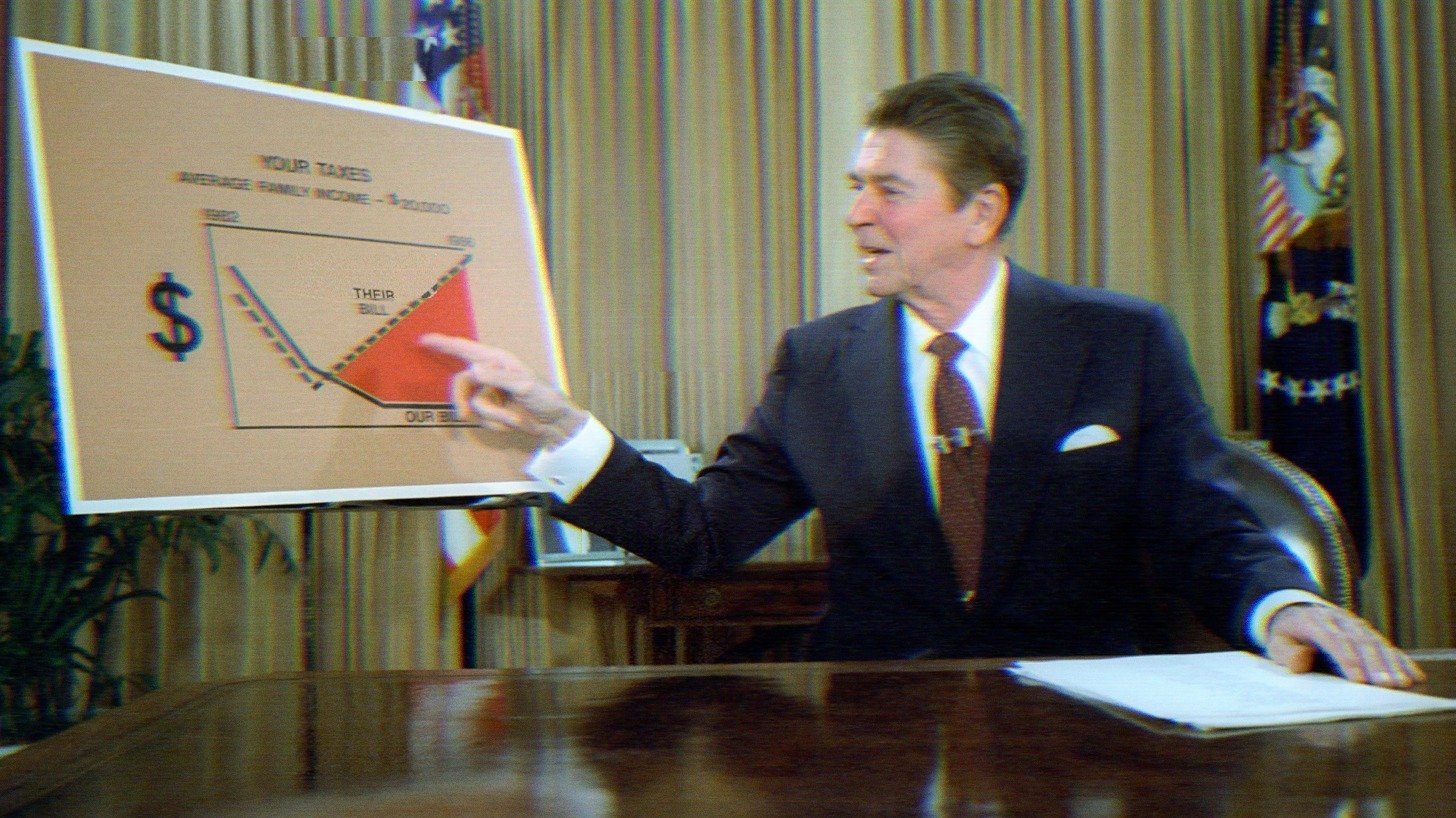

Image Description: Ronald Reagan sits at a desk in the Oval Office, gesturing toward a chart comparing tax bills for an average family income of $20,000 between 1982 and 1986. The chart shows two diverging trend lines with a shaded area representing the difference between the two tax scenarios.

Image Description: Ronald Reagan sits at a desk in the Oval Office, gesturing toward a chart comparing tax bills for an average family income of $20,000 between 1982 and 1986. The chart shows two diverging trend lines with a shaded area representing the difference between the two tax scenarios.

Imagine you’re at a dinner party. The host announces they’re going to feed the wealthiest person at the table an enormous feast, and whatever crumbs fall from their plate will eventually make their way down to everyone else. Sounds insulting, right? That’s trickle-down economics, and for the past 40 years, American workers have been waiting for crumbs that never came.

The promise was simple and seductive. Cut taxes for corporations and the wealthy, and they’ll invest that money in ways that create jobs, raise wages, and grow the economy for everyone. The rising tide lifts all boats. A win-win for capitalism and the working class.

Except we have four decades of empirical evidence proving it’s a scam. Not a failed experiment. Not a theory that didn’t quite pan out. A deliberate wealth transfer mechanism from working people to the rich that succeeded perfectly at enriching those at the top while leaving everyone else treading water, or drowning.

And in 2025, after Donald Trump signed the latest iteration of trickle-down into law with his “One Big Beautiful Bill,” it’s time to put this zombie economic theory back in the grave where it belongs.

The Origin Story—How We Got Here

To understand why trickle-down economics persists despite overwhelming evidence of failure, we need to go back to where it started. Not as economic policy, but as political strategy.

On Aug. 13, 1981, Ronald Reagan signed the Economic Recovery Tax Act (ERTA) at his California ranch, marking what would become known as the Reagan Revolution. ERTA included a 25% reduction in marginal tax rates for individuals, phased in over three years, and indexed for inflation. The 1981 act, combined with another major tax reform act in 1986, cut marginal tax rates on high-income taxpayers from 70% to around 30%. The legislation substantially reduced the top individual federal income tax rate from 70% to 50%.

The promise: these cuts would unleash economic growth that would benefit all Americans. Reagan’s advisors, armed with Arthur Laffer’s economic theory, promised that supply-side economics would turbocharge the economy. Critics called it “voodoo economics”—George H.W. Bush’s memorable slam during the 1980 primary. Bush’s press secretary Peter Teeley coined the phrase to mock Reagan’s fantasy that slashing taxes for the rich would somehow juice the economy. Bush feared, correctly as it turned out, that massive tax cuts would explode the deficit and trigger inflation.

They were right to be skeptical.

What actually happened? The national debt tripled during Reagan’s presidency, growing from $907 billion when he took office to $2.6 trillion by 1988—an increase of $1.69 trillion. And here’s the kicker: much of the 1981 tax cut was reversed just one year later. By the summer of 1982, the double-dip recession, soaring interest rates, and exploding deficits had convinced Congress that the Reagan tax cuts weren’t working. In September 1982, Reagan signed the Tax Equity and Fiscal Responsibility Act (TEFRA), a measure widely described as one of the largest peacetime tax increases in U.S. history, aimed at curbing a soaring budget deficit that had followed his 1981 tax cuts and a deep recession.

But the damage was done. The Reagan tax cuts established a pattern that would define American economic policy for the next four decades: massive tax cuts for the wealthy, exploding deficits, stagnant wages for workers, and blistering inequality. Each time Republicans gained power, they ran the same play. Each time, they promised different results. Each time, the outcome was the same.

The Bush tax cuts of 2001 and 2003. The Trump tax cuts of 2017. And now, in 2025, Trump’s “One Big Beautiful Bill” is making his first-term cuts permanent and adding trillions more in giveaways to corporations and the wealthy.

Forty years of the same failed experiment. Forty years of the rich getting richer while working people’s wages stagnate. Forty years of rising inequality masked by soaring stock markets that workers don’t benefit from because they don’t own stocks.

Let’s look at what the data actually shows.

The Data Doesn’t Lie—Four Decades of Failure

Numbers don’t have political affiliations. They don’t care about ideology. They just are. And the numbers on trickle-down economics are damning.

The Wealth Gap Has Exploded

As of the fourth quarter of 2024, the top 10% of American households by wealth held 67.2% of total wealth, while the bottom 50% held just 2.5%.

The bottom half’s share of wealth hit an all-time low of just 0.4% in 2011. Over the past three decades of supposed economic prosperity, the wealth share of half the country has been cut by nearly a third, while the total wealth pie grew exponentially.

The Forbes 400 tells the story in stark terms. In 1982, the “poorest” billionaire on the list had $240 million (in today’s dollars); by 2024, you needed $3.3 billion just to crack the top 400, and the average member held over $13 billion—an 18-fold increase even after adjusting for inflation. Wealth isn’t trickling down. It’s concentrating upward at breakneck speed.

The economic fallout from the pandemic made things even worse. The collective net worth of America’s top 12 billionaires surpassed $2 trillion, with their combined wealth increasing by more than $1.3 trillion, or 193%, between March 18, 2020 and December 3, 2024. While ordinary Americans suffered from COVID-related health and economic crises, billionaires saw their fortunes nearly triple.

This isn’t the natural order of capitalism. This is the predictable result of deliberate policy choices to shower the wealthy with tax cuts while workers saw their bargaining power systematically dismantled.

Wages Have Stagnated While Productivity Soared

Here’s the smoking gun that proves trickle-down doesn’t work: the productivity-pay gap.

From 1979 to 2024, cumulative median wage growth was just 29%—less than 0.6% per year on average. Meanwhile, productivity grew 83.1% over the same period, according to the Economic Policy Institute (EPI).

Indeed, American workers became vastly more productive—they produced more value per hour worked. But they didn’t see the rewards. The gains went somewhere else. Specifically, they went to executives and shareholders.

For production and nonsupervisory workers—the vast majority of the American workforce—average real wages have grown by only 0.7% over the half-century from February 1973 to February 2022, per the American Enterprise Institute. In 50 years, wages increased by less than 1%. That’s not stagnation. As EPI now correctly calls it, that’s “wage suppression.”

Even college education stopped being a guarantee of decent wage growth. In 2013, inflation-adjusted hourly wages of young college graduates were lower than they were in the late 1990s. The promise that education and hard work would lead to prosperity? That’s been broken for an entire generation.

The CEO-Worker Pay Gap Is Obscene

If wages haven’t grown for workers, where did all the money go? Look up.

CEOs at the 350 largest publicly traded U.S. firms took home an average of $22.98 million in realized compensation in 2024. That’s up 5.9% from 2023, and a staggering 1,094% increase since 1978.

CEO pay grew by over 1,000% since 1978, while typical worker compensation grew just 24%.

In 1978, CEOs made 31 times what typical workers made. By 2024, they made 281 times as much.

The most egregious example? Starbucks CEO Brian Niccol received $97.8 million in annualized total compensation in 2024—6,666 times more than Starbucks’ median employee, who made just $14,674. The median Starbucks worker would have had to start working in 4643 BC—during the Stone Age—to earn what the CEO earned in 2024 alone.

This isn’t just offensive on moral grounds. It’s economically destructive. Because here’s what companies are doing with their profits and tax savings.

Stock Buybacks Instead of Wage Increases

When corporations get tax cuts, trickle-down theory says they’ll invest in workers, equipment, and expansion. What actually happens? Stock buybacks.

Between 2019 and 2023, Lowe’s spent $42.6 billion on buying back its own shares—enough to reward each of the firm’s 285,000 global employees an annual $29,865 bonus for five years. Instead, CEO Marvin Ellison enjoyed total compensation of $18.2 million while the median annual worker pay was just $32,626 in 2024.

Home Depot spent $37.2 billion on share repurchases over the same period, enough to have given each of the company’s 463,100 global employees an annual bonus of $80,355.

Stock-related pay now accounts for 79% of average realized CEO compensation, averaging $18.2 million in 2024. The incentive structure is clear: executives are rewarded for inflating stock prices through buybacks, not for investing in workers or long-term growth.

Trickle-Down 2.0

Just when you thought we’d learned our lesson, here comes Trump with the “One Big Beautiful Bill”—a $5 trillion love letter to the wealthy dressed up as middle-class tax relief.

Signed into law on July 4, 2025, the legislation represents the largest tax cut in history (if you believe the marketing). The Tax Foundation estimates the bill will reduce federal tax revenue by $5 trillion between 2025 and 2034 on a conventional basis. Even with “dynamic scoring” that assumes economic growth, the cost still reaches $4.1 trillion, meaning economic growth would only pay for 19% of the tax cuts.

The remaining 81%? Added straight to the deficit. Which will then be used to justify cutting Social Security, Medicare, Medicaid, food assistance, and every other program that actually helps working people.

What’s In the Bill

The One Big Beautiful Bill makes permanent the 2017 Trump tax cuts, including the 21% corporate tax rate. It includes permanent 20% small business deductions for pass-through entities, permanent 100% bonus depreciation, and full expensing for business investments.

The estate tax exemption increases to $15 million beginning in 2026, indexed to inflation—a massive giveaway to wealthy families looking to pass on dynastic wealth.

The bill temporarily raises the state and local tax (SALT) deduction cap from $10,000 to $40,000 from 2025 through 2029, primarily benefiting high earners in blue states.

The False Promises

The White House and congressional Republicans made sweeping claims about the bill’s benefits. They promised the typical family would get up to $10,900 in additional take-home pay, workers would see increased wages up to $7,200, and up to 7.4 million jobs would be protected and created.

The Council of Economic Advisers projected America’s GDP would increase by an estimated 5.2% over four years and 3.5% in the long term.

Sound familiar? It’s the exact same promise Reagan made in 1981. Bush in 2001. Trump in 2017. The playbook never changes because it’s not designed to deliver on the promise to workers. It’s designed to deliver wealth to the top while providing political cover through misleading projections.

Who Really Benefits

Despite claims that this is the “largest middle-class tax cut in history,” the structure tells a different story.

The 755 CEOs listed in the AFL-CIO’s Executive Paywatch database will save a combined $738 million in income tax cuts thanks to the One Big Beautiful Bill. Nearly three-quarters of a billion dollars goes to just 755 individuals.

Meanwhile, in 2024, CEO pay at S&P 500 companies increased 7% from the previous year to an average of $18.9 million in total compensation, while the median U.S. worker made just $49,500—a mere 3% bump.

The pattern is clear and consistent: when we cut taxes for the wealthy and corporations, the wealthy and corporate executives get richer. Workers get scraps, if anything.

Why It Doesn’t Work—The Fatal Flaws

Trickle-down economics fails for three fundamental reasons that no amount of wishful thinking can overcome.

Flaw #1: The Wealthy Don’t Spend Tax Savings the Way Middle-Class People Do

Economics has a term for this: the marginal propensity to consume. It refers to how much of each additional dollar of income a person spends versus saves.

Give a working family an extra $1,000 and watch what happens: it’s spent by the end of the month. Groceries. Overdue bills. Car repairs. Kids’ school supplies. That money doesn’t disappear—it flows directly into the local economy. The grocery clerk stays employed. The mechanic orders parts. Small businesses stay afloat. The spending multiplies through the community, creating real economic activity that benefits everyone.

When you give a billionaire an extra $1 million in tax cuts, they don’t suddenly buy a thousand times more groceries. They already have everything they need. Instead, that money goes into financial instruments, asset purchases, or just sits in wealth management accounts. It doesn’t circulate through the economy in ways that create jobs or raise wages for ordinary people.

This isn’t a moral judgment. It’s a mathematical reality. The wealthy have a much lower marginal propensity to consume because they’re already consuming everything they want. Additional income goes to savings and investments that primarily benefit other wealthy people.

Flaw #2: Corporations Optimize for Shareholders, Not Workers

Modern corporate governance has a dirty secret: companies are legally structured to maximize shareholder value above all else. Labor isn’t an investment to be nurtured—it’s a cost to be minimized.

When corporate profits increase, the money flows in a predictable pattern: First to shareholders through dividends and stock buybacks. Second to executives through stock-based compensation tied to share price increases. Third, if there’s anything left and labor markets force their hand, maybe to workers through modest wage increases.

This isn’t a conspiracy. It’s how the system is designed. Stock-related components now constitute 79% of CEO compensation, creating powerful incentives to boost share prices through buybacks rather than investing in workers or long-term productive capacity.

Remember the Lowe’s and Home Depot examples? Together, these two companies spent nearly $80 billion on stock buybacks between 2019 and 2023—money that could have transformed the lives of hundreds of thousands of workers but instead inflated executive compensation and shareholder returns.

Flaw #3: Investment Follows Demand, Not Tax Cuts

This is the most fundamental misunderstanding of how the economy actually works.

Businesses don’t hire people or build factories because they have extra cash sitting around. They hire and invest when demand for their products and services increases. If consumers aren’t buying, no amount of tax cuts will convince a rational businessperson to expand.

Tax cuts that go to the wealthy don’t create consumer demand because, as we established, the wealthy already consume everything they want. Tax cuts and direct support for working people do create demand because those people immediately spend money on things they need but couldn’t afford.

Strong consumer demand → businesses invest to meet that demand → businesses hire workers → workers earn wages → workers spend wages → demand increases further. That’s how you create a virtuous cycle of growth.

Trickle-down reverses this logic. It tries to stimulate the economy from the supply side while starving demand. It’s like trying to make a car go faster by putting a bigger engine in it while draining the gas tank.

The Progressive Alternative—Build from the Bottom Up

Economies grow from the bottom-up and middle-out, not top-down. This isn’t ideological. It’s empirical. And we have a clear blueprint for how to build an economy that works for everyone, not just those at the top.

At UNFTR, we’ve articulated 5 Non-Negotiables of the Left—policy foundations that are empirically proven, wildly popular, and essential for a functioning society. Let’s be clear about how each directly counters the failed logic of trickle-down economics.

Non-Negotiable #1: Housing First

Housing First succeeds where market-based approaches fail because it recognizes housing as a foundational human right, not a commodity to be earned. The true drivers of America’s homelessness crisis are structural: severe housing shortages, stagnant wages combined with rising housing costs, inadequate social safety nets, and the financialization of housing where homes are treated as investment vehicles rather than places for people to live.

Non-Negotiable #2: A Civilian Labor Corps

With AI and automation threatening to eliminate millions of jobs in the coming decade, we need a proactive response. As we detailed in our Civilian Labor Corps explainer, Goldman Sachs projects that up to 300 million jobs could be impacted by generative AI worldwide in the next decade.

A government-sponsored Civilian Labor Corps would provide living-wage employment to anyone willing and able to work, focusing on high-value community work the private sector won’t address: climate resilience projects, elder and child care, affordable housing construction, ecological restoration, and infrastructure modernization.

This directly inverts trickle-down logic. Instead of giving corporations tax cuts and hoping they create jobs, we guarantee employment doing essential work. The wages circulate through local economies, creating real demand that drives sustainable growth.

Non-Negotiable #3: Medicare for All

The U.S. healthcare system isn’t broken—it’s working exactly as designed. The problem is it was designed to generate profits, not health outcomes.

Medicare for All eliminates the profit-seeking middlemen who add zero value to healthcare delivery while siphoning hundreds of billions annually from the system. In 2021, revenues for the health insurance industry alone topped $1.2 trillion. That’s over a trillion dollars not going to doctors, nurses, hospitals, or patient care.

Non-Negotiable #4: Getting Money Out of Politics

This is the long game. The current campaign finance system developed over decades, from Buckley v. Valeo in 1976, establishing political spending as protected speech, through Citizens United in 2010, which effectively eliminated restrictions on corporate political spending.

According to Americans for Tax Fairness’ analysis, 100 billionaire families spent a staggering $2.6 billion on the 2024 election, representing one in every six dollars of total political contributions. This marks a nearly 163-fold increase in billionaire political spending since the Supreme Court’s 2010 Citizens United decision allowed unlimited campaign donations. In the 2008 presidential election—before Citizens United opened the floodgates—billionaires spent just $17 million on campaigns.

The only solution is a constitutional amendment that limits speech protections to natural persons, prohibits all non-individual spending on candidates or election issues, and requires full transparency for political donations. It will take decades to get money out of politics, but so did building the current corrupt system.

Non-Negotiable #5: Climate Action

We’ve known about climate change for over 150 years. In 1856, scientist Eunice Foote discovered the heat-trapping effect of carbon dioxide. In 1990, a U.S. Naval War College report warned that climate change would drastically affect naval operations, predicting extreme weather, drought, flooding, sea level rise, and increased conflict over scarce resources. In 1978, Exxon scientists discussed the greenhouse effect and warned that doubling CO2 levels would increase global temperatures by 2-3 degrees Celsius, with serious implications for agriculture and climate. By 1982, Exxon’s own internal documents warned that failure to reduce fossil fuel use could result in “some potentially catastrophic events” that “might not be reversible.”

Yet, we’ve done almost nothing because powerful fossil fuel interests benefit from the status quo. Trickle-down logic says we can’t afford aggressive climate action. The reality? We can’t afford not to take climate action.

Trickle-Down Economics Is Still Dead, and We Know What Actually Works

Trickle-down economics isn’t dead because it failed. It’s dead because it succeeded at its actual purpose: transferring wealth from working people to the rich while providing political cover through false promises of shared prosperity.

The data is overwhelming. The trends are undeniable. And the 2025 “One Big Beautiful Bill” is just the latest iteration of the same scam. These are the predictable outcomes of policy choices that prioritized capital over labor, shareholders over workers, and the wealthy over everyone else.

However, we know what actually works: Strong wages driving consumer demand. Unions giving workers bargaining power. Progressive taxation funding public goods. Universal programs providing economic security. Housing, healthcare, and employment as rights, not privileges.

The choice is clear. We can continue down the path of trickle-down economics, watching inequality explode while pretending the next tax cut for billionaires will finally help working people. Or we can build an economy from the bottom up, where prosperity is shared and everyone has the opportunity to thrive.

Forty years of evidence should be enough. Trickle-down is dead. Let’s build something better.

Image Source

- Series: Reagan White House Photographs, 1/20/1981 - 1/20/1989 Collection: White House Photographic Collection, 1/20/1981 - 1/20/1989, Public domain, via Wikimedia Commons. Changes were made.

Updates from the collective UNFTR team.