$5 Gasoline: The Real Culprit Revealed

Image Description: A rich man and woman holding cash and smoking cigars are laughing, while a man fills up his gas tank in horror.

Image Description: A rich man and woman holding cash and smoking cigars are laughing, while a man fills up his gas tank in horror.

Becky Quick: “Energy prices continue to climb, energy stocks continue to climb. Do you think there’s any end in sight to that trend?”

Jeff Currie: “We’re just beginning. We like to argue this is the first innings of a commodity supercycle, and it’s not just oil and gas, it’s metals, mining, it’s agriculture. Because, you know, the sector has suffered from a decade plus of underinvestment. And I want to emphasize that even though Exxon is reaching a cyclical high right now, the reality is the amount of money in this space is still very, very small. We haven’t seen a rotation. The only money that’s really coming into this space is share buybacks, so, yeah, you’re going to look at pictures that show the rotation of energy up and tech down, but the reality is we haven’t seen a big influx of capital into this space, so are you too late entering this space? Absolutely not. It’s just beginning.”

This is how Wall Street talks about the energy sector. Sure, there are platitudes about pain at the pump and policy measures to bring down prices, but there are a few key points from even this brief clip that tell you everything you need to know about what the fuck is going on with gas prices.

‘Max. Been there, done that haven’t we? Didn’t we cover crude oil? Didn’t we talk through the market manipulation angle already?’

Well, apparently no one in the pundit class or general news media got the fucking memo, so here we are again. My guess is you’ve heard one or all of the following factors as the reason why prices at the pump are high:

-

Biden’s stimulus and recovery plan gave too much money to consumers, so we’re spending like assholes. It’s our fault.

-

Everyone is traveling again and living their lives, so demand is out of control and outstripping supply. Again, our fault.

-

Biden’s war of words with the fossil fuel industry during his campaign magically made prices go up. So ,it’s Biden’s fault.

-

The war in Ukraine. Putin’s fault.

-

The uneven global recovery from the pandemic has impacted refineries and capacity. China’s fault?

-

Biden has handcuffed U.S. oil and natural gas production by killing projects like the Keystone pipeline. Biden’s fault.

Only one of these is true. And only partially so. So the goal here is to prep you so you can summarily dismantle each one of these talking points and squarely point the finger at who’s to blame.

In the opening clip, Currie talks about how the sector has suffered from a lack of investment for decades. That might sound like there’s a lack of investment into the businesses themselves, like for equipment, machinery and labor, but that’s not what he’s talking about. So let’s translate what that means. Essentially, what he’s saying is that the energy sector has been ignored by Wall Street money relative to huge growth areas like tech. And that even the recent influx of capital into energy shares is small relative to the earnings share it has on the S&P.

In other words, he’s suggesting that energy stocks are still undervalued and underfunded because he believes that the sector is only at the beginning stages of a massive comeback. That’s not good news for you, me and the planet.

So energy stocks are a good buy. So what? Does this translate to what really matters to us—the price of goods, transportation, inflation in general? The short answer is, it does and it’s not good. The real kick in the ass is that it also doesn’t have to be this way.

In our Peak Oil episode, which we re-released in conjunction with this piece to provide some context, we walked through the history of oil as both a commodity and currency and how the price of it no longer reflects true market forces.

Here’s a quick recap:

In the olden days, crude oil was difficult and expensive to extract from the ground. And there was a consensus that proven reserves were finite and we would therefore run out at some point in the future. This was the theory of Peak Oil, referred to as the “Hubbert curve,” named for the geologist who first did the math in the 1950s. All things being equal, with available information at the time, we would have hit peak oil in the 1970s, then the world’s supply would begin to decline over a period of decades.

Then, a few things happened. The oil companies got really, really good at finding oil and pulling it out of the ground. A true technological revolution. Then they found it in the ocean. And the tar sands. Literally everywhere. Suddenly, supply wasn’t an issue. So, as the global economy grew, U.S. consumption went off the fucking rails and petrostates from Venezuela to Saudi Arabia and Equatorial Guinea to Norway and the U.S. to Russia were awash in petrodollars.

And, speaking of dollars, the most effective way to track the price of oil, considering it was being pumped around the world, was to mark it in U.S. dollars. So, here are the two most important takeaways from this era: up to and including this period of time the only two economic determinants of price were supply and demand and the strength of the dollar.

Here’s why:

If oil is priced in dollars and the dollar is strong, it takes fewer dollars to buy a barrel of oil. Likewise, if the dollar is weak, it requires more of them to buy a barrel. Historically, there’s an inverse relationship. So, if supply is meeting demand—meaning oil companies are pumping, refining, distributing and storing enough oil to meet consumption demand in the broader market, then the value of the dollar will be the driver of any real change to the price of oil.

On the flip side, if demand begins to outpace supply, then the price of oil will increase because that’s economics 101. And vice versa. If we have more oil than we need, the price will go down. Why and how this happens is extremely important and helps us rejoin the story in the early 1970s.

Two important things happened in the early 1970s. The first was when OPEC members pulled crude off the market in solidarity with Egypt and Syria. The second was when a man named Leo Melamed created an investment product on the Chicago Mercantile Exchange to trade on the price of oil. What Melamed understood was that the only thing that mattered in trading was volatility. The OPEC maneuver created volatility previously unseen, which spelled opportunity for investors who could now gamble on whether the price of oil would go up or down. Something as important to the world economy as crude oil should have never been a casino bet, but here we are.

So the one thing that changed from our fundamental understanding of how oil is priced on the market—beyond supply and demand and the value of the dollar—is that it became a speculative vehicle.

Hold that thought.

So what goes into the price of gasoline—the price we pay at the pump as consumers?

If we think about the journey from ocean floor or desert sand to the pump, it will make sense. Remember, we’re not talking about natural gas or the products that are made from that. We’re talking about crude oil specifically. Natural gas is a different animal, though it’s closely related. For our purposes, we’re just talking about from the desert sand to the gas pump.

$ — First, you have to drill it. Extract it from the ground. That costs money. So those companies get paid. Now. Very important before we move on. This price. Right now, at this moment, is what you see quoted on the exchanges. So, if it’s $110/barrel, that is how much it costs right at this moment. Now, we add to it along the way.

$$ — Then you have to transport it from the rig to the refinery, where it’s turned into something else. Something called a distillate. Refineries will convert crude oil, which is essentially useless in its most basic form, into light, middle or heavy distillates for use in various processes. We cover this in the Peak Oil episode, but you’re talking about anything from jet fuel and automobile fuel oil to kerosene, home heating oil and motor oil. These refineries also have to get paid.

$$$ — From there, the distillates have to move to storage facilities. So the transportation companies and the storage companies will need to get paid as well. Then it moves again from the storage facility to smaller distribution centers, or directly through a network of trucks and tankers that take it to gas stations, as our prime example, to be poured into your gas tank. The gas stations also need to get paid, by the way.

$$$$ — It’s at this point that you pay taxes on what you pump. These funds go directly to the state you’re in and always to the federal government.

So, each step of the way, companies are getting paid for this process, and that’s how the dollars and cents begin to mount. Prior to the inflationary bubble this year, there was general consensus that the optimal price of crude oil is between $55 and $65 per barrel. Meaning, at that level, there was enough margin for all of these players along the chain to make money.

So, using an implied price calculator, if crude oil is priced at $65 per barrel, the price for a gallon of gasoline would be around $2.46. Remember, Unf*ckers, this is for the United States. The rest of the world typically pays more for gasoline, something every idiot that puts a sticker of Joe Biden on a gas pump fails to understand.

(Just for a little context, by the way, in U.S. dollars the price of gas in France is about $8 a gallon, in Germany it’s $7.50 and in Norway it’s $10, and Norway is a massive petrostate. Do you think there are stickers of the King of fucking Norway on the gas pumps there saying, “I did this?”)

Anyway, using the same price calculator at current crude oil prices, we should only be paying around $3.70 at the pump. So, we still have work to do to explain the difference here.

Most of the difference is something called the crack price, and it’s happening in the middle of the process we described. “Cracking” is an industry term used to describe the process of cracking crude from its base form into something else. Basically, the refining process.

Here is where there is a slight bit of truth relative to the price woes at the pump. Because of the uneven recovery process, different parts of the economy are coming online in an uneven fashion. This translates into production issues at refineries because the demand for middle distillates has been higher than normal. Middle distillates include jet fuel, diesel, kerosene and home heating fuel. Because of the resurgence of travel and the need to move more goods at sea and on land, the demand for these distillates has been higher.

So, refineries are running at full capacity trying to manage the increase in crude supply to not only meet the demands of the consumer for gasoline, but other areas of the economy as well that are at the early stages of recovery.

There’s a negative feedback loop to consider too. Because transportation is a key element of final pricing and diesel fuel is so expensive, transportation companies are adding a premium to their services as well, because it’s so expensive for them to fuel up just to deliver the very fuel that they’re using!

With this understanding of how crude oil is priced on the market and all the companies that have to get paid along the way, let’s review the reasons everyone tells us for high gasoline prices and dismantle them one by one before I send you off into the world to argue with your friends.

Biden gave too much money to consumers, so we’re spending like assholes.

This is a supply and demand argument. Essentially, we as consumers have so much money in our pockets that we’re outpacing the world’s ability to meet our insatiable needs. Bottom line, demand for crude in 2022 is only now approaching where it was in 2019 prior to the pandemic.

So if supply is meeting demand and demand is slightly less than it was at the same time in 2019, what was the price of a barrel of crude in June of 2019? Surprise, surprise. It was $65 per barrel.

Everyone is traveling again and living their lives, so it’s our fault.

Travel has yet to reach the levels it did in 2019 and is beginning to cool due to high prices, as a matter of fact. It was a relatively mild winter, and road trips look like they too will fall short this summer due to, of course, high fuel prices. Another negative feedback loop, so I call bullshit.

Biden’s war of words with the fossil fuel industry magically made prices go up.

Candidate Biden might have said he would push to transform our energy policy to pursue a renewable future, but most of those dreams died when the Senate killed Build Back Better. And even BBB fell short of the dream, so this is just utter bullshit. Fossil fuel companies have tons of open leases as it is, and the Biden administration reversed its decision to halt new leases on federal lands. There’s simply no truth to this allegation.

The war in Ukraine. It’s Putin’s fault.

To the extent that fear is baked into the prices, I can accept this. The reality on the ground, however, is that Russia not only hasn’t stopped pumping crude, but it’s killing it right now. Have we made it harder to pay for? A little. But they’ve worked around it and, for the time being, they still have customers taking their supply of oil and natural gas. This is going to change due to new EU regulations and sanctions, but they haven’t even begun to implement these changes, so right now it’s pretty much status quo.

Again, there’s enough supply globally to handle demand anyway, and we have plenty of time to ramp up production in the future if need be. The bottom line is that it has nothing to do with the current calculus, which is pretty much backed up by every U.S. and global energy agency that believe “uncertainty” is behind the rise in prices rather than actual economic factors.

The uneven global recovery from the pandemic has impacted refineries and capacity. So it’s China’s fault?

This is the one that is partially true. This relates to the crack pricing that we talked about before. Refineries are running at capacity to fill in the gaps for middle distillates. It’s worth noting, though, that there’s profiteering here as well. For example, the adjusted quarterly earnings for Marathon Petroleum, one of the largest refinery operations in the world, are up 2.5 times this quarter over last year to $2.6 billion. They’ve also bragged about stock buybacks, as most of the energy companies have done, which is a prime indicator that these companies are all flush with cash. If it was a true dollar-for-dollar increase that was being passed along, their revenues would be up, but profits would remain relatively stable. In other words, they’re charging a premium for cracking because they know no one is looking.

And, with respect to China, China is still relatively dormant due to its renewed COVID lockdown policies. So all of these price increases that we see are without China’s real participation. I shudder to think what it will look like when China comes fully back online.

Biden has handcuffed U.S. oil and natural gas production by killing projects like the Keystone pipeline. Biden’s fault.

We have no problem moving oil and gas around this country. We’re the largest producer of both in the world. Keystone Pipeline is a red herring thrown out by conservative media to get you to look away from the real problem.

Let’s put it all together now.

- The dollar is strong AND crude oil prices are up. That’s illogical and goes against economic fundamentals.

- Supply is meeting global demand.

- Global demand is slightly less than what it was in 2019 when oil was $65 per barrel during the same period.

- Oil companies from drillers, transporters and refineries are recording record profits.

In fact, in an interview with CNBC at the World Economic Forum in Davos, Switzerland, Fatih Birol, executive director of the International Energy Agency said, “In the last five years, on average, [the] oil and gas industry made revenues [of] about $1.5 trillion. And this year, from 1.5 it will go to $4 trillion U.S. dollars, more than [a] two times increase in the oil and gas companies’ revenues.”

- The war in Ukraine hasn’t slowed down the supply of oil coming from Russia.

- Countries across the globe, including the United States, have released crude from their strategic oil reserves to backstop any potential gaps in supply. So it’s not supply and demand.

- China’s still closed, so it’s not China.

- It’s not Russia, because they’re still pumping oil and making money.

- It’s not the dollar, because the dollar is strong so oil should be cheap.

- It’s not Biden’s war on fossil fuel, because these companies are recording record profits.

- And it’s not us, because all the money they gave us during the pandemic is fucking gone.

So I guess it’s the oil companies then, right?

Yes and no. I promised I would tell you who is to blame, so here we go:

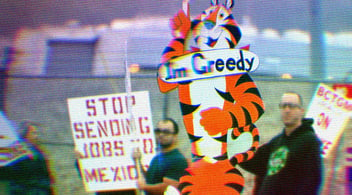

The oil companies are the beneficiaries, for sure. And, to the extent that they manage and run trading desks, they’re part of the problem. The real culprit behind high gasoline prices is Wall Street, and here’s why.

The bond market is in shambles. The stock market is as well. Right now, Goldman Sachs, JP Morgan Chase and others are chasing returns, so they’ve turned to the market of last resort and they’re making a killing. They don’t even have to increase the trading volume in the sector because they’re the ones that name the price in the forecast. By forecasting the price, they essentially set the price. They don’t have to lift a finger to move the market. Just appear on television and say the magic words.

“We think, depending upon how the sanctions go in Europe, we could see—the European sanctions on Russian energy—we could see maybe a hundred and fifty dollars a barrel. Maybe a little higher.” -Francisco Blanch, Bank of America

“We think Brent [crude] prices have to go higher another twenty dollars.” -Damien Courvalin, Goldman Sachs

“My expectation is we’re going to see crude prices continue to rise.” -Helima Croft, RBC Capital Markets

“JP Morgan predicts the nationwide average for gas could reach $6.20 a gallon by August.” -JP Morgan forecast, quoted on Fox’s Washington DC affiliate

And remember from our Peak Oil episode that these are the big, named players. But there are others who trade on what’s called the OTC—over the counter markets. Trading desks owned by the actual energy companies themselves that are also placing bets on the price of commodities.

They’re pushing up prices because they can’t find returns anywhere else, Unf*ckers.

They’re doing it because they can.

They’re getting away with it because they know we don’t know.

And Congress is either in on it or too stupid to understand that they’re getting snowed.

Wanna know how I know that?

Okay. Here’s just one small example of how everyone in Congress is acting in a different movie. Literally no one on the same page, or even looking at the same script.

The New York Times reported that the Biden administration is thinking of announcing a tax holiday on gas. Basically eliminating federal gas taxes to bring down prices at the pump, which some believe would reduce prices by about $.05 cents per gallon. Hey, it’s something. Now listen to what the Times reported in terms of opposition:

“The White House will face an uphill battle to get Congress to approve the holiday, however. While the administration and some congressional Democrats have for months discussed such a suspension, Republicans widely oppose it and have accused the administration of undermining the energy industry. Even members of Mr. Biden’s own party, including Speaker Nancy Pelosi, have expressed concern that companies would absorb much of the savings, leaving little for consumers. Senator Joe Manchin III, Democrat of West Virginia, said this year that the plan ‘doesn’t make sense.’”

This is the federal tax on gasoline that goes from the consumer to the government and is theoretically used to fund federal highway programs. This is budgeting farce, by the way, because it’s not like there’s a separate bank account for highways, it all gets washed in the federal budget. Anyway, Republicans say that this undermines the energy industry. Except that the industry literally has nothing to do with this.

But how about that, Nancy Pelosi? Concerned that “companies” would absorb the savings? How the fuck is she doing that math? Joe Manchin saying it doesn’t make sense? This limited and feckless gimmick has nothing to do with anything, so I can’t even understand why the fuck any of them would have a problem with this. But this is the level of incompetence we’re dealing with in Congress and why something as stupid as a gas tax holiday can’t even get passed.

Anyway, the answer is Wall Street, Unf*ckers. They’re taking your money because they can’t take it from the stock market or bond market. Are the oil and gas companies profiting from it all? Of course. Because that baseline price—the price of a barrel of crude—ultimately goes into their pockets as well. But the reason that baseline price is so high to begin with isn’t actually their fault. That’s a head fake. It’s Wall Street. It’s always Wall Street.

Congress isn’t stupid, its members are just in Wall Street’s pocket.

Oil should never have been allowed to be traded on an exchange.

When it comes to gas prices, remember… It's not your fault.

Here endeth the lesson.

Max is a political commentator and essayist who focuses on the intersection of American socioeconomic theory and politics in the modern era. He is the publisher of UNFTR Media and host of the popular Unf*cking the Republic® podcast and YouTube channel. Prior to founding UNFTR, Max spent fifteen years as a publisher and columnist in the alternative newsweekly industry and a decade in terrestrial radio. Max is also a regular contributor to the MeidasTouch Network where he covers the U.S. economy.