SPACtacular Bullsh*t.

Inside Trump’s Multi-Billion Dollar Sham.

Image Description: Donald Trump in front of a stock ticker.

Image Description: Donald Trump in front of a stock ticker.

He did it again. We thought, “finally.” Finally he’s done for. There’s no way he has the money to pay the bond for the civil fraud case. He’s gonna have to sell stuff. It’s going to be so much fun watching them rip his name off of buildings.

People. This is Donald J. Trump we’re talking about here.

- He’ll never get elected after the grab 'em by the p-tang comments.

- He can’t hire his kids in the administration, right?

- He’s a Russian operative.

- Look at him, he’s cozying up to North Korea.

- They're gonna get him on these impeachments.

- He cheated on his pregnant wife with an adult film star then paid hush money to her from campaign funds.

- He’s gonna die of COVID.

- He tried overthrowing the government for Christ’s sake, he can’t run for office ever again.

- You know, he might do jail time after all.

Got elected. There was no pee tape. Thumbed his nose at the Emoluments Clause. Hired his kids. Hung out with Kim Jong Un. Impeached but stayed in office. Twice. His lawyer went to jail for the hush money fiasco, but he didn’t. Didn’t die of COVID. Still not in jail. Eligible to run. And now he’s increased his wealth by billions of dollars by taking his social media platform public, despite the fact that it hemorrhages money.

And they reduced the bond so he’ll likely be able to manage it without selling assets.

The only thing we value more than wealth is celebrity and this guy’s got both. Even if his wealth is inflated and he got rich by screwing people over, he shits on a golden toilet and that’s enough. Even if his celebrity is from reality television and generally being a high profile douche, he’s famous as fuck. And the presidency made him arguably the most famous person on planet Earth.

The rich and powerful do not pay for their sins. Unless they commit them against other rich and powerful people like Madoff did. How many bankers went to jail for the financial crisis? One. Some low level dude from Credit Suisse you’ve never heard of. How many Bush administration officials stood trial for war crimes in Iraq? None. Kanye West is a virulent anti-semite who sympathizes with Nazis and he just dropped a new album.

In America we lavish praise upon the rich and famous and imprison whistleblowers. The only time things go sideways for the elite is when they turn on one another. That’s the cardinal sin. Those who walk the halls of power are in a fraternity. Delta Phi Beta Go Fuck yourself. And you’re not in it.

So, yeah. Trump’s a certified billionaire again.

Wanna know how he did it?

Chapter One: Blank Check

Most people read the headlines and see that Donald Trump’s company went public thereby adding billions to his billions. The reality of the situation is both more complicated and actually simpler. It’s simple in that the mechanism that Trump used to get his Truth Social company listed on the Nasdaq is the most straightforward way to do so. I’ll explain more on that in a bit. What’s more complex is this mechanism has fallen out of favor with regulators and investors and Trump’s particular case is more of a shit show than these things are normally. Imagine that.

So let’s start with the basics and then we’ll get into the nitty gritty of Trump’s new company.

The process of taking a company public is long, arduous and very, very expensive. Most companies that go public are already very successful and seeking exponential growth by accessing capital in the public markets. It typically takes years to build enough critical mass and consistent revenue growth along with healthy profit margins to get there. Assuming you have such a company, the regulatory gauntlet you have to pass through is formidable and requires multiple experts. Underwriters, insurers, investment bankers and so many attorneys come together to create a package with an estimated value. Then the leaders or owners of the company hit the road to raise money prior to an initial public offering from savvy inside investors that will get a premium on their initial investment when, or if, the company ever goes public.

Everything and everyone is vetted along the way. Transparency is essential. Company performance over an extended period is critical. Seasoned executives with experience at the helm is a must. Early investors with a track record send important signals to Wall Street. Insurance companies back up the financial claims that are themselves backed up by external auditing firms. The SEC will conduct forensic audits and bury the management team with compliance requirements. Only then will the investment bankers attempt to place a value on the offering and test the waters in the market.

The other type of company that follows this path is the unicorn. It could be hemorrhaging money month after month but is so special that it doesn’t matter. Think Amazon. It took Jeff Bezos nine years to turn a profit at Amazon, long after it had gone public. Same thing for Tesla, which had its first profitable quarter ten years after its founding. High growth companies like these usually have very deep pocketed investors that are well respected on Wall Street and stories so unusual that they enter the public’s imagination. FedEx. Amazon. Tesla. ESPN.

And then there’s Truth Social.

Trump’s Truth Social has been a disaster from the beginning. First off, it’s lousy tech. Second, it’s bleeding cash and there’s no appreciable revenue model in sight. The last published financials on the company prior to going public showed that Truth Social managed to lose about $49 million through nine months in 2023 on around $3.3 million in revenue. It’s estimated that the platform has somewhere in the neighborhood of 5 million active users, which is a rounding error compared to the behemoth social platforms. And not to go all Hillary Clinton on you by calling the users deplorable, but when you consider the demographic information on those 5 million users, I’m guessing that it’s not all that advertiser friendly.

Don’t be an elitist. That’s why people hate progressives.

You’re right. My bad. I’m sure there are plenty of ammunition and survival kit companies out there that want to advertise on the platform.

You’re doing it again.

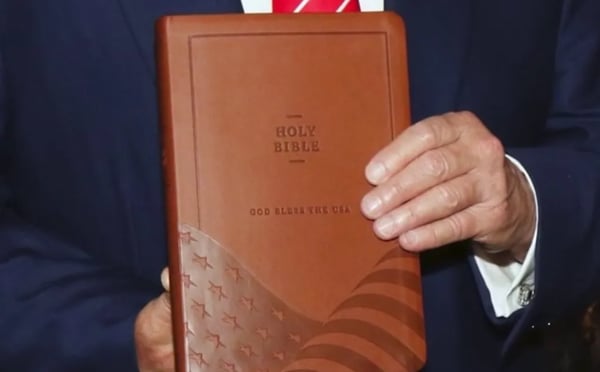

You’re right. My bad. The point is that these companies thrive on data mining and monetizing said data through advertising or with data brokers. 5 million is nothing. Trump would be better off selling bibles.

Oh, wait…

Trump holding a King James bible with the American flag and “God Bless the USA” inscribed on the cover. Credit: Truth Social

Anyway, Truth Social is not a unicorn. There’s nothing remarkable about it and it has literally no upside. It will never be profitable. Its revenue is about the size of an average independent pharmacy. It has somewhere between 50 and 200 employees, though most are likely subcontractors. In other words, it’s a scam. Now to make matters more interesting, it went public inside of a shell company that also has no revenue, only a handful of employees and no other purpose than to get Truth Social listed on a public exchange. So a scam within a scam promoted by the biggest scam artist on the planet.

Truth Social is the brand held within Trump’s company called Trump Media and Technology. But we’ll refer to it as Truth Social for the ease of things. It merged with a company called Digital World, which now goes by the ticker symbol DJT, which stands for Dumb Jackoff Turd. Now, Digital World is no ordinary company. No sir. It’s what’s known as a Special Purpose Acquisition Company (SPAC). These are publicly traded investment vehicles created for the sole purpose of acquiring or merging with an existing private company, effectively taking it public without going through the traditional IPO process.

SPAC Attack

SPACs have been around for several decades but gained popularity in the early 2000s. They’re referred to on Wall Street as “Blank Check” companies because that’s essentially what they are. Money in search of an idea. The first modern SPAC is widely considered to be the "Jumbo Kingdom" deal in 1997, where David N. Baker, a lawyer, and investment banker, used a SPAC to acquire the Jumbo Floating Restaurant in Hong Kong. This success helped establish the SPAC model as a legitimate way to take companies public.

But it was a tech bro named Chamath Palihapitiya who set the SPAC world ablaze. For a while, Chamath was the fucking man. He came through Facebook where many credited him as the agent of change in the halls of the social giant. From there he went on to become a glitzy renaissance investor. When Chamath spoke, people listened. When he invested, they followed. He made a fortune on Facebook and Tesla stock then seemingly couldn’t miss. So when he announced that he was going big into the world of SPACs it was game on.

Chamath rolled out SPACs one after the other. He was so bold he simply referred to them alphabetically, listing them as IPOA, IPOB, and so on. The rush was on. Rates were dirt cheap, money was flowing from the government during the pandemic and Chamath was shilling for SPACs like the ShamWow guy. And it wasn’t just tech bros who were eating it up, it was all of Wall Street.

What Chamath and others figured out was that high profile people from celebrities to Wall Street titans could skip the hard part of going public and get listed with just a filing and a promise. The idea people are called sponsors or promoters. These promoters rally individual investors or institutional investors around a very loose concept; a holding company in search of something to hold if you will. These initial investors come in at very favorable terms, typically with something called warrants, which allows them to purchase severely discounted shares of the SPAC once it’s listed on an exchange. The trick here, however, is all about timing.

The SPAC usually has a limited amount of time—between 12 and 18 months—to identify an acquisition. And even these early investors are prohibited from cashing in their shares for a determined period of time to ensure that the SPAC is more than a glorified pump and dump scheme. The funds are held in a trust account until the SPAC identifies a target company to acquire and once a target is identified, the SPAC undergoes a merger or acquisition, effectively taking the target public. If the SPAC fails to complete an acquisition within a specified timeframe, it must return the funds to its investors.

The upside, in theory, is enormous. For investors, SPACs provide an opportunity to invest in early-stage companies with the potential for high returns, often without the same level of risk associated with traditional IPOs. For target companies, SPACs offer a faster and more predictable path to going public, as well as access to capital and experienced management teams.

Despite their benefits, SPACs also come with risks. One major risk is that investors in the SPAC IPO may lose their entire investment if the SPAC fails to complete an acquisition. Additionally, the terms of the merger or acquisition may be unfavorable to existing shareholders, leading to dilution of their ownership stake. Then there’s the fact that regulators hate these vehicles. I mean HATE. Like every other public company, SPACs are subject to regulation by the Securities and Exchange Commission (SEC) and other regulatory bodies, similar to other publicly traded companies. However, there are some differences in the regulatory requirements for SPACs, particularly regarding disclosure and reporting obligations. And each passing year, the SEC is making it more and more difficult for SPACs to maneuver because, well, for the most part they suck.

For example, literally none of Chamath’s SPACs ever worked out. In fact, they’ve been a disaster. The ones that survived the holding period are down significantly. Others either closed or never even got off the ground, which has made Chamath somewhat of a pariah in investment circles. For his part, Chamath mostly blames high interest rates but the fact of the matter is that most SPACs simply didn’t deliver on the promise because they skipped the line and were all sizzle and no steak.

Chapter Two: Trump’s Spactastic SPAC

“Nice work if you can get it.” That’s how Morningstar Vice President of Research John Rekenthaler describes the SPAC gambit. Here’s how he describes the funding scheme behind SPACs generally and how it applies to Trump’s platform.

“The ladder of SPAC investors contains five rungs, four of which are occupied by institutions. On top are 1) the SPAC sponsor and 2) the underwriter, which put up little money. Further down the ladder are 3) the investors who deliver the seed capital and 4) PIPE investors. Those two parties supply the merger’s cash, while receiving volume discounts. Finally comes the public, which buys its shares on the secondary market. It obtains no special favors.

“In other words, public shareholders pay a SPAC’s way. It must be so. If each of the other four parties collect fees from the SPAC or receive discounted shares, then the fifth party must foot the bill. The math insists. That holds particularly true with Digital World, for two reasons. One, the company’s PIPE investors received unusually favorable terms. Two, its acquisition target is a shell that brings no assets to the bargain. Thus, public shareholders are twice diluted--once by the SPAC’s insiders, and then again by Trump Media & Technology’s ownership stake.”

That even Trump would find an unusual way to go about an already unusual investment should come as no surprise. Once again, the chief grifter in charge had to pony up little, if anything, other than his name. In return he receives extremely favorable terms on this investment of nothing. According to some analysts, just the cash portion of what he received once it went public was in the hundreds of millions, which would be enough to cover his bond in theory. But it’s the valuation of the stock that everyone is really focused on. Before we get there, let me explain just how much of a grift this thing is because, as we know, Trump associates himself with only the best people.

To be clear, there is some big institutional money behind this. Susquehanna International, LPL Financial and a host of other wealth management firms and family offices. But those are the so-called PIPE investors that take the big risk for the warrants. It’s the promoters, the guys that put the whole thing together in the first place, that are super interesting. Here are the names of the promoters that conceived of the Digital World SPAC. Patrick Orlando, Luis Orleans-Braganza, Bruce Garelick, Justin Shaner, Brian Shevland, Eric Swider and Lee Jacobson.

You might as well have said Warren Buffet, Mark Cuban, Bill Ackman and Carl Icahn.

Yup. A real “who’s who.” Or, more like “who dat?”

So let’s start with the original CEO, Patrick Orlando. Orlando was a little known financier from Florida whose impressive resume included a defunct biofuel company in Peru, a deal with Venezuela to finance tugboats and another venture in China. The only real record of his accomplishments lay in the trove of lawsuits he typically left in his wake, such as Benessere Capital Acquisition Corporation. Remember that name. But he had enough to muster up a $25,000 investment into the Digital World SPAC and he knew how to organize one. His stake is purportedly worth around $600 million even though he was ousted from the company.

Then there’s a weird Brazilian connection. Luis Orleans-Braganza was the founding CFO of the company. Orleans-Braganza is generally referred to as Prince because of familial ties to Brazil’s last emperor, a position he believes should be reestablished and, boy, does he know just the guy who could fill it. He was a vocal supporter of Donald Trump and maintained close ties with Jair Bolsonaro. Oh, he’s also no longer with the company.

Or Bruce J. Garelick, formerly of Rocket One Capital and other financial startups, who was on the founding board. The SEC filed charges against Garelick this week for trading in advance of the SPAC announcement through Rocket One. Another fancy term for that would be “insider trading.”

Founding board member Justin Shaner was also associated with defunct and troubled Benessere Capital, which was subpoenaed by the SEC last year.

Brian Shevland of Bluestone Capital Management, also a founding board member of Digital World, was suspended by the SEC from acting as a broker.

Eric Swider was also a Benessere guy and Lee Jacobson was involved in multiple failed ventures including Apmetrix Analytics, which was liquidated in Chapter 7 proceedings in 2019.

Damn. These really are the best people.

Chapter Three: What happens next is what always happens next.

This first part is a guess. The second part you can bank on. First part is that I’m guessing the Trump controlled board offers him special dispensation and removes the prohibition on selling stock before the six month mark. I don’t think it will happen immediately, but I think it will happen in short order as his trials heat up.

And the campaign right?

Yeah, right. Trump won’t use a penny of it on the campaign. That’s what the suckers at the super PACs and the RNC are for. That and the truckload of free daily media he always gets.

The second part is way more bankable. At some point Digital World, ticker DJT, owner of Truth Social, has to actually perform. The people who put this together originally have all made a killing. The investors, even the institutional ones, however, are in a position of tremendous risk right now. Unless Digital World has another acquisition up its sleeve—like a real one—then this one is fucked. This is Game Stop. A pure pump and dump scheme, except it’s not gamer and crypto bros fucking with the system. It’s real people and real companies pouring money into a publicly listed company that has a valuation of around $8 billion today for a holding company with an asset that generates about $4 million in revenue and $50 million in losses.

Never, and I mean never, in the history of investing has math made less sense. But you know this much. Donald Trump won’t get hurt. Can’t get hurt. He’s already won because of the up-front fees he participated in. And if the board grants him the ability to liquidate shares in the coming weeks then he’ll have literally pulled off the con of the century. Shit. Maybe longer.

I guess what amazes me is no matter how many times or how many ways he fucks people over, there will be those who give him a pass. And many who will applaud him for it. It’s like that moment in the debate with Hillary Clinton when he was accused of dodging taxes and he didn’t refute it. He leaned into it and said that’s what makes him smart. When he went to Michigan and told the auto workers that he might hate unions but he hates management more. And when this thing goes belly up he’ll talk shit about the investment banks and Wall Street types and tell his followers that they all deserved it. And they’ll cheer and they’ll laugh. They’ll buy the merchandise and maybe even a Trump bible. And most importantly they’ll vote for him.

After this latest move it is official: He’s the greatest conman who ever lived.

Here endeth the lesson.

Image Source

- Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons. Changes were made.

Max is a political commentator and essayist who focuses on the intersection of American socioeconomic theory and politics in the modern era. He is the publisher of UNFTR Media and host of the popular Unf*cking the Republic® podcast and YouTube channel. Prior to founding UNFTR, Max spent fifteen years as a publisher and columnist in the alternative newsweekly industry and a decade in terrestrial radio. Max is also a regular contributor to the MeidasTouch Network where he covers the U.S. economy.